Stire 03.07.2024 ⋅ 0 comentarii

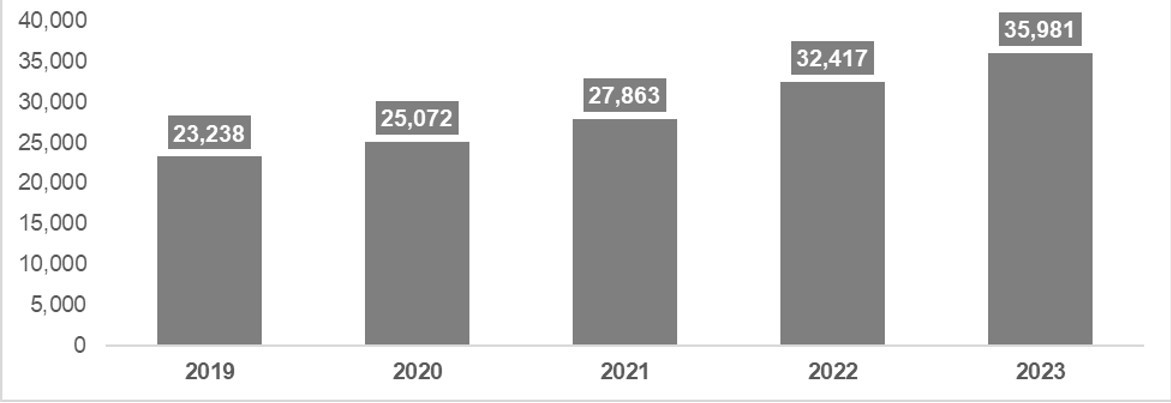

Cushman & Wakefield Echinox: Romanians spent €36 billion in large retail chains across 2023, up 11% vs. 2022; supermarkets and hypermarkets accounted for more than 60%

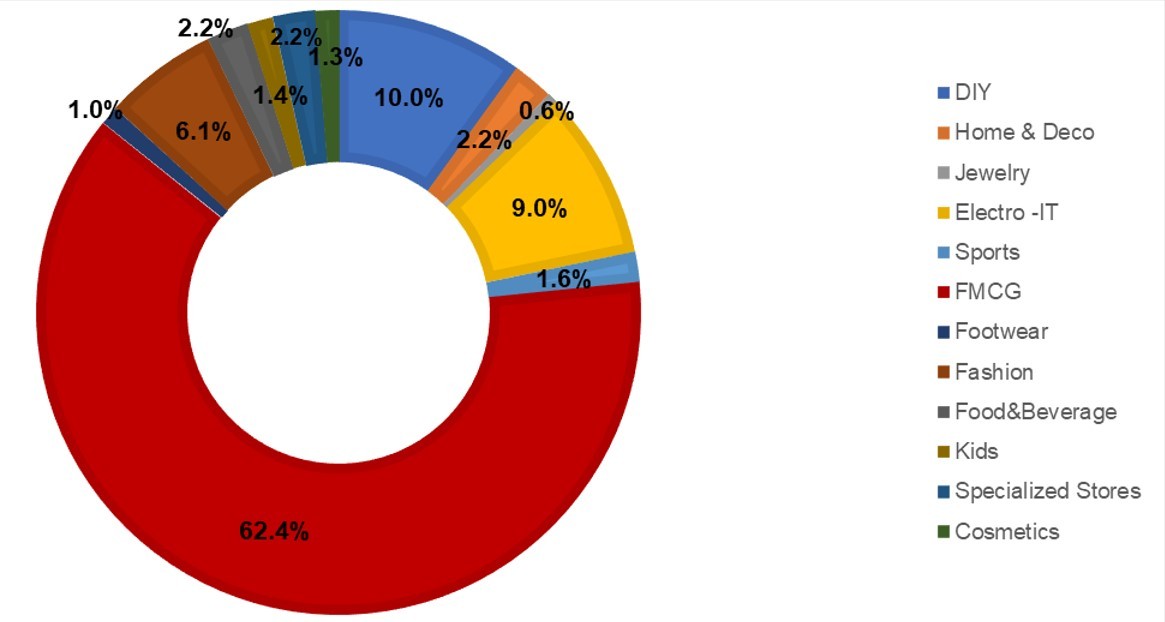

Bucharest, July 2024: Romanians spent €36 billion in large retail chains, an amount 11% higher compared with 2022, out of which the FMCG spending accounted for €22.5 billion euros (more than 60% share), according to the Romania Retail Snapshot 2024 performed by the Cushman & Wakefield Echinox real estate consultancy company, based on the financial results of 116 companies from 12 different retail segments.

The second largest share (€3.6 billion and 10% respectively) pertained to DIY stores, a segment followed by Electro-IT (€3.3 billion and 9%) and Fashion retailers (€2.2 billion euros, 6.1%). Jewelry (€212 million, 0.6% of total sales), Footwear (€356 million, 1%) and Cosmetics (€458 million, 1.3%) retailers had the lowest shares in the shopping basket analyzed in the report.

Total Revenues breakdown by segments

Source: Cushman & Wakefield Echinox Reserch based on the data published by the Ministry of Finance and National Institut of Statistics

The 2023 annual turnover growth rate was slightly above the annual the inflation rate (10.4%) and slowed down compared with 2022, when the corresponding spike was of 16.3% vs 13.8% inflation.

Overall turnover evolution (MIL €)

Source: Cushman & Wakefield Echinox Reserch based on the data published by the Ministry of Finance and the National Institute of Statistics

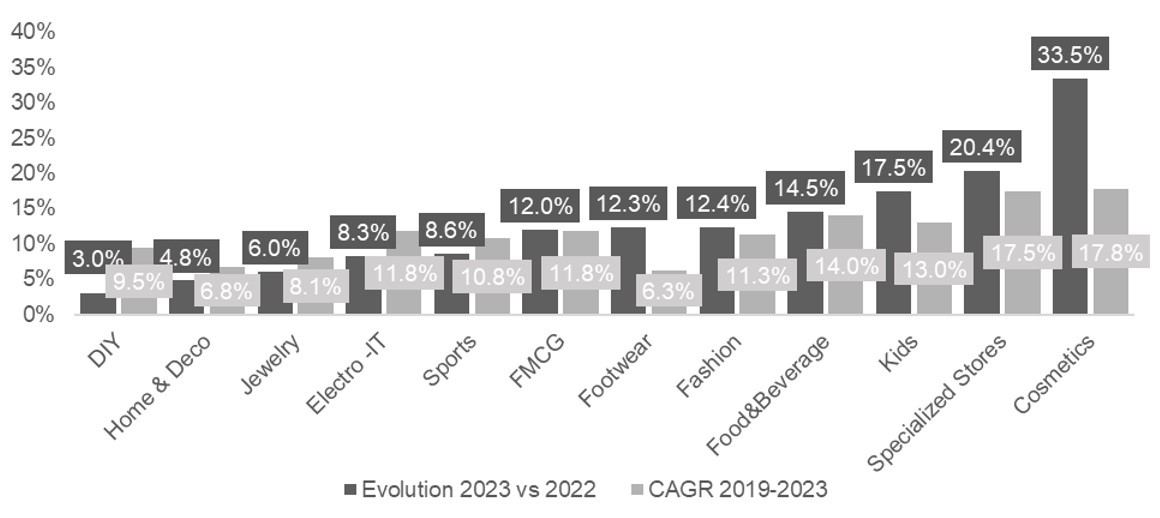

All the analyzed retail segments recorded higher y-o-y turnovers in 2023, with the largest increases being reported by the Cosmetics (33.5%), Specialized Stores - pet shops, newsstands, tobacco, specialized drug stores etc. (20.4%), Kids & Toys (17.5%) and Food & Beverage (14.5%) retailers.

The 12 analyzed sectors are FMCG (major hypermarket/ supermarket chains), Fashion, DIY, Sports, Footwear, Kids & Toys, Jewelry, Home & Deco, Food & Beverage, Cosmetics, Electro-IT, and Specialized Stores. Together, the 116 retailers in question have more than 6,000 stores in Romania, located mainly in shopping centers, retail parks and commercial galleries.

The lowest turnover growth rates in 2023 (below the the average annual inflation rate) were reported by the DIY (3%), Home & Deco (4.8%), Jewelry (6%), Electro – IT (8.3%) and Sports (8.6%) segments.

All the other segments recorded sales growth rates above inflation: 12% FMCG, 12.3% Footwear, 11.3% Fashion.

Vlad Săftoiu, Head of Research, Cushman & Wakefield Echinox: “The retail market performed very well throughout last year, despite the fact that 2023 was the second consecutive year with a double-digit inflation rate. Therefore, all the segments from our snapshot recorded sales increases compared with 2022, most of them above inflation. Moreover, an expanded analysis of the entire 2019 – 2023 period shows that the average CAGR (compound annual growth rate) for the major retail operators (11.5%) was clearly above the average annual inflation rate during the same timeframe (7.9%). The forecast for this year is also positive, considering the official public data which illustrates a consistent retail sales growth compared with the same period in 2023".

The average annual sales growth rate from 2019 to 2023 exceeded the average annual price growth for most categories (11.5% vs 7.9%), with the exception of Footwear (6.3%) and Home & Deco (6.8%) retailers. On the other hand, the Cosmetics segment experienced the highest surge in this period (17.8%), followed by specialized stores (17.3%).

The turnover increases reported by the large retailers was sustained both through expansions and organically, due to a growth in sales in physical stores and to the online expansions performed by a series of operators.

These expansions have also come as a result of the investments made by developers (in shopping centers and retail parks) who completed more than 50 projects between 2019 and 2023, consisting in both new schemes and expansions of existing ones, totaling more than 715,000 sq. m of new modern retail spaces.

Turnover evolution by activity sector in 2023 vs 2022 and CAGR revenue 2019 - 2023

Source: Cushman & Wakefield Echinox Reserch based on the data published by the Ministry of Finance and the National Institute of Statistics

Cushman & Wakefield Echinox is a leading real estate company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, owners and tenants. For more information, visit www.cwechinox.com

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2023, the firm reported revenue of $9.5 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), sustainability and more. For additional information, visit www.cushmanwakefield.com.